Is Digit legit? One of our favorite savings app that we can't get enough of is the Digit App.

By saving a little bit every day, the Digit budget app can really turn your finances around. It is often compared to Acorns because both apps make saving for your goals easier.

Almost all of us would agree that setting aside savings is important for our overall financial health.

However, for most of us, the most difficult thing about saving money is figuring out how to get started. Wouldn't it be easy to learn how to save money and get paid to do it?

Believe it or not, there is with Digit.

Quick facts about Digit:

- Saving money used to be hard. Now it's easy!

- Digit is an effortless way to save money without thinking about it.

- Every day, Digit checks your spending habits and moves money from your checking account to your Digit account, if you can afford it.

- Available for iOS and Google Play.

What is Digit?

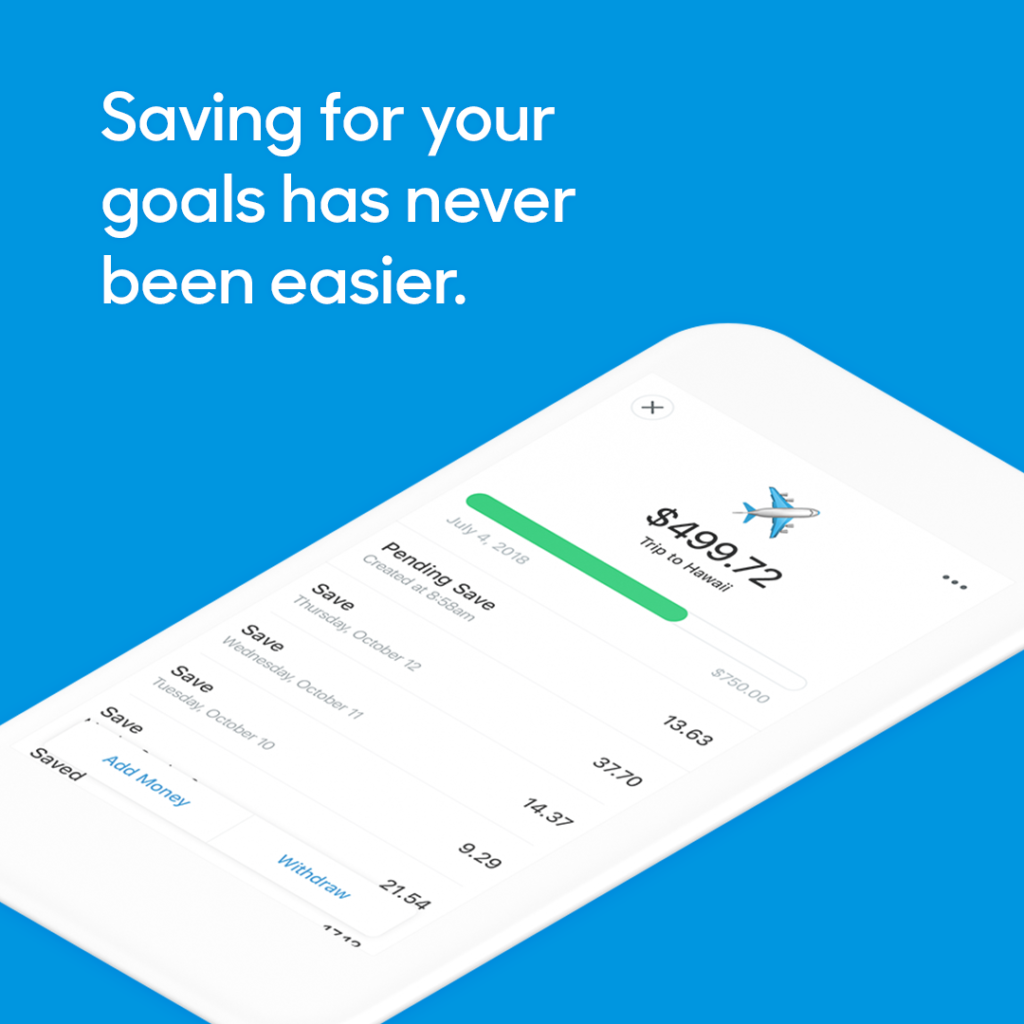

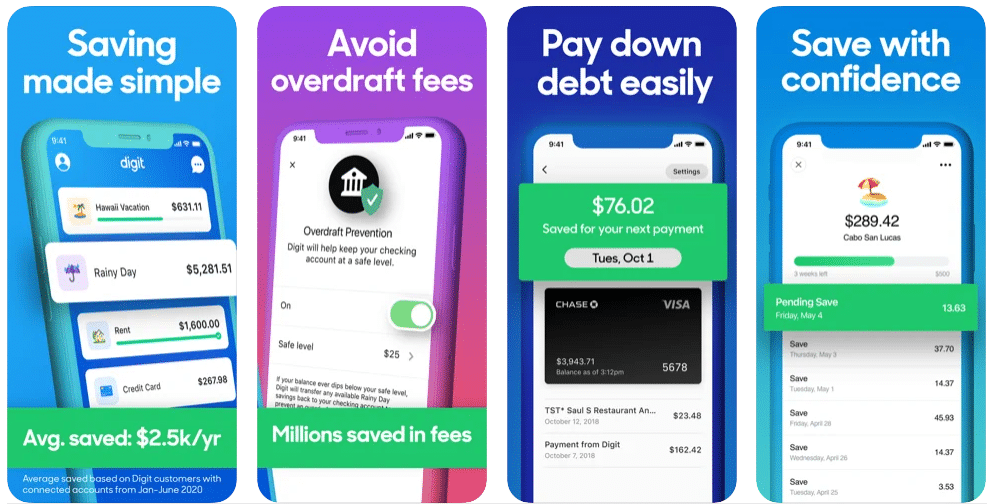

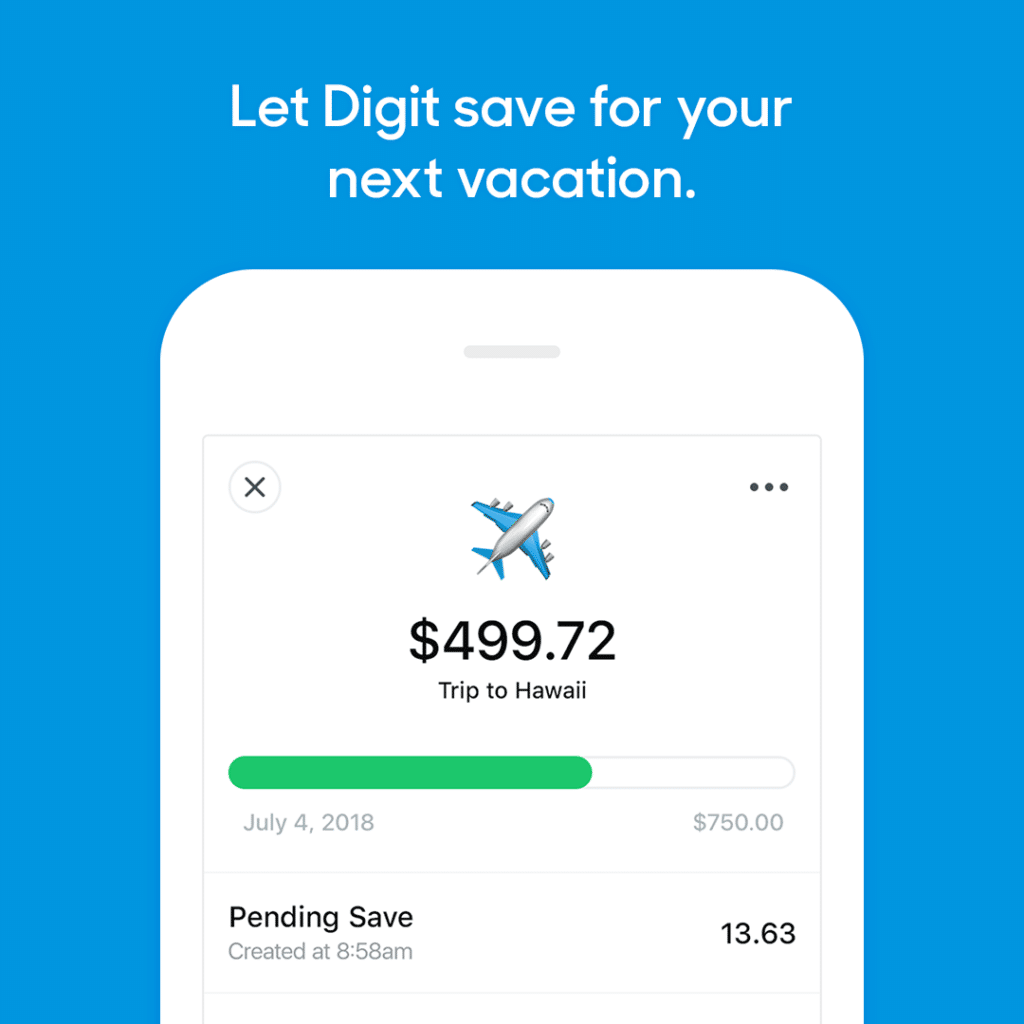

Digit is essentially a budgeting app with a goal of making savings a mindless task for its users. The app is a micro-savings platform (similar to the best coupon apps) that analyzes your spending to determine the perfect amount that you can save over time. Then it makes automatic withdrawals and transfers it to your savings without you even thinking about it.

As Digit’s CEO Ethan Bloch had it, the goal of the app is to make saving as easy, stress-free and automatic as possible.

Simply put, Digit does all the hard work of getting started with your savings. You can go with your regular financial habits and the app figures out how much can be the extra amount and move it into your savings. And, all that is done automatically so you won’t even notice it.

Is the Digit Budget App Legit?

Building your savings is simple and totally legit with Digit. This innovative app saves your money without you having to lift a finger.

Simply link it to your checking account, and its algorithms will determine small (and safe!) amounts of money to withdraw into a separate, FDIC-insured savings account.

However, after the end of your 30-day free trial, a Digit membership is $5 per month, billed directly from your connected checking account. The subscription begins automatically unless the Digit account is closed before the end of the trial period. The company will send you a reminder ahead of time via email.

Digit Savings

Ultimately, the goal of Digit is to push non-savers to save money. All you need to do is sign up for the app and connect your checking account.

The app works by evaluating your financial lifestyle and spending patterns and moves the extra money to your Digit account. The amount of extra money the app automatically transfers will depend on different factors including your checking account balance, your upcoming income, upcoming bills and your recent spending.

The Digit app is free for the first 30 days. After that, you’ll be charged $5 monthly and you can cancel anytime. It offers a 1% annual savings bonus when you save using the app for three consecutive months.

Funds held are FDIC insured, up to $250,000 per depositor. It also enables you to make convenient transactions using your phone SMS services and allows unlimited withdrawals 24/7. When it comes to security, the app utilizes advanced 128-bit encryption to enhance protection of sensitive user information and transactions.

Pros/Cons of the Digit Budget App

Pros

- A great set-it-up-and-forget-it app which makes saving easier and automatic.

- Simplified savings goals.

- You get an annual savings bonus of $1.

- It’s easy and convenient to use and you don’t have to set up a savings account to use the app.

Cons

- Monthly charge of $5. Think before you start paying any amount to save money.

- Not available internationally, as it’s only currently available for US-based users.

- Customer contact is limited, no phone or chat support. So, if you have concerns the closest thing you can do is contact them via email.

Apps like Digit

Since one of our favorite automated savings apps, Digit, announced that they would be adding a monthly fee we were looking for other comparable saving apps.

So here are other round up saving apps like Digit:

Digit App Competitors

Current

Current is a mobile banking app that offers payday advances of up to $750 with no hidden fees. It provides early access to your paycheck when you set up direct deposit, helping you cover expenses before payday.

With a seamless mobile experience, Current allows you to track spending, save automatically, and access fee-free overdraft protection. You can get your money faster and manage your finances without waiting on traditional banks.

Current is free to use, and signing up takes just minutes. If you need a payday advance or early paycheck access, it’s a solid alternative to Digit.

- Get up to $750 before payday with direct deposit

- $50 bonus when you deposit $200+ with code WELCOME50

- No credit check, no fees, totally free to join

Acorns

Another app like Digit that you’ve probably heard of is Acorns. It’s been seen on Business Insider and CNBC as one of the best micro-investing apps.

Acorns will earn you money by having your spare change invested in the stock market and compounded daily.

Once you connect the app to a debit or credit card, it rounds up your purchases to the nearest dollar and funnels your digital change into an investment account. Sign up to try it risk-free with a $20 sign up bonus.

Once you get the process automated, Acorns investments make your digital change work for you. I downloaded it and within a year I had almost $2500 in my account.

Remember, you’ll get a $20 bonus when you sign up and make your first investment! The sooner you start investing, the sooner your money can start to grow toward your goals.

Acorns is available in the Google Play Store and Apple App Store.

- Invest your spare change automatically.

- Join almost 4,000,000 people saving and investing every day.

- Sign up in no time to save and invest more money

- Money is invested in a portfolio based on income and goals

- Automatically invests your spare change from daily purchases

- $20 bonus when you sign up and invest just $5

- Costs $3/month (free if you're a student or under 24)

Digit Budget App Summary

The Digit app can be a great platform to launch your savings habit for short-term savings goals. The best thing about the app is that it does everything automatically for you. If you are a non-saver the Digit app savings can help push you to become one.