The best budgeting apps can help you save money, alter your spending habits, create a debt payoff plan, and so much more.

Americans with a budget feel more confident, secure, and in control of their finances, according to data from the Certified Financial Planner Board of Standards.

One of the most important responsibilities that one needs to take over as an adult, for themselves and/or their family, is managing the financial aspects of the household.

Managing the finances of a household would include keeping a keen eye on the income and expenditures, maintaining a good savings rate, and preparing a nest egg that can be used for any unforeseen future expenditures.

Though an important task, it can be a very complicated one and many do not know the first step to managing their finances.

However, with the development of today's technology, free help is available on your smartphone.

There are many budgeting apps available on your phone which can help you manage your money for free.

The Best Budgeting Apps of 2025

- Best overall: Quicken Simplifi and Acorns

- Best budgeting app for hands-on users: YNAB

- Best tool to evaluate investment accounts: Empower

- Best apps for stopping spending: PocketGuard and GoodBudget

I downloaded dozens of the best budgeting apps and narrowed down the best out of the bunch.

My overall ranking system was predicated on how easy it was to help you do one thing and the number one rule in personal finance: spend less than you earn.

Here are a couple more rules to follow before choosing:

The budgeting app should be simple to use

No need to get fancy — you should be able to download and start using your budgeting app without any major complications. Creating a monthly budget should be easy but if you need a tutorial to get started — use another one.

It should be cheap or free

When you are looking to create a monthly budget — don't spend any money and start saving money. There are a lot of free budgeting apps out there that allow you to budget without cutting into your budget. Start with something simple and cheap and stick to it!

The best budgeting apps can help you easily monitor, save, and invest your money.

Best overall: Quicken Simplifi and Acorns

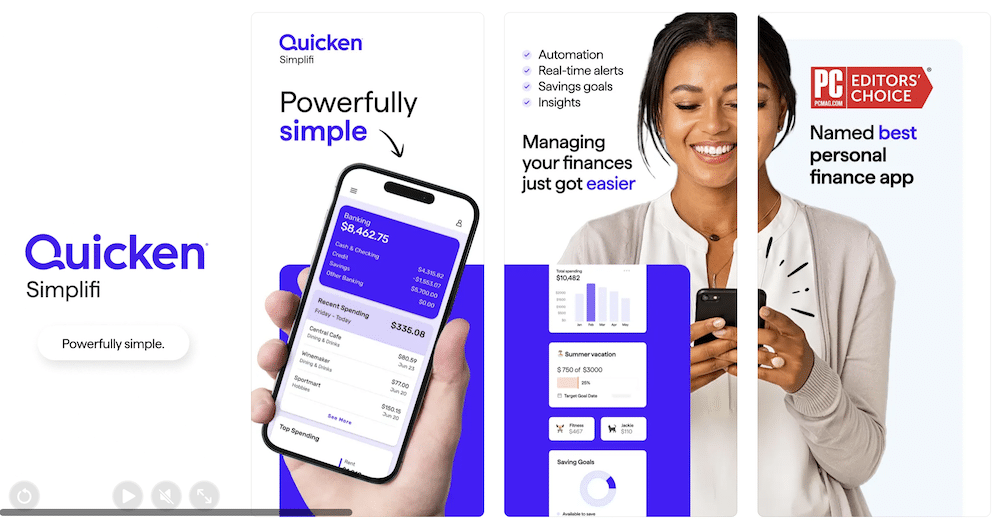

Quicken Simplifi

Quicken Simplifi is a budgeting app that helps you track your financial health. It can track bank accounts, investment accounts, credit cards, payment services, loans, and even 401(k) accounts.

Simplifi is a cloud-based app that works on the web and most mobile devices. It doesn't have ads, but users pay a monthly or annual fee.

Pros

- The menus and tools are easy to navigate and understand.

- Provides information on spending plans, upcoming bills, and goals.

- Shows projected balances for the next few weeks based on income and bills.

- Can generate detailed financial reports and investment tools.

Cons

- No free option.

- No credit score insights.

- No tax planning abilities.

- Issues with two-factor authentication.

Considering its user-friendly interface and robust financial tools, Simplifi stands out as the ideal choice for those seeking a comprehensive view of their finances along with insightful tips to maintain financial goals. It's particularly suited for individuals who value an ad-free experience and are willing to invest a modest fee for this convenience. It costs $5.99 per month, or $3.99 per month if billed annually.

Download:

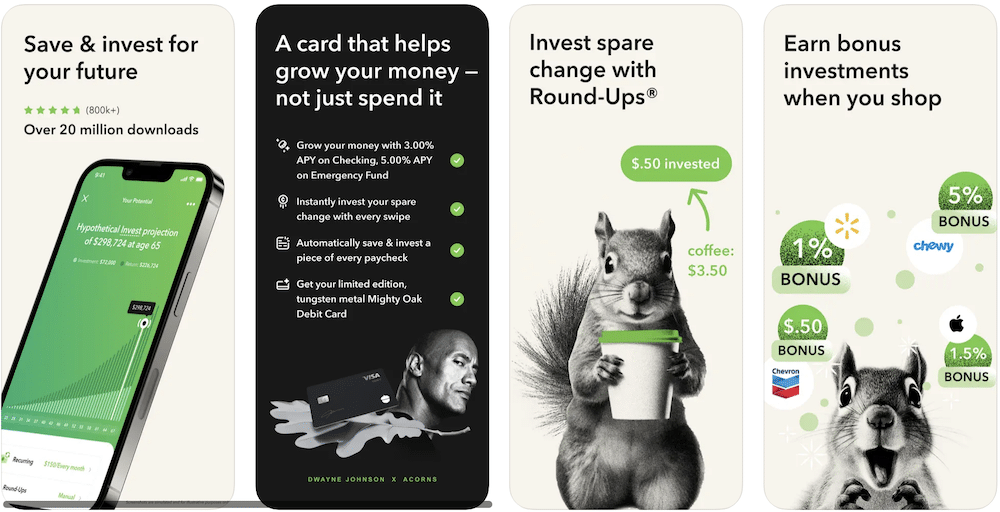

Acorns

Acorns is a versatile financial tool that aids in crafting personal budgets, setting and tracking savings goals, and managing checking and savings accounts. It simplifies financial management by enabling automatic monthly transfers to your bank account, along with providing valuable budgeting strategies and tips for account management.

This app can also help you take the first step into investing your money. Acorns is also a robo-advisor that invests money into a diversified portfolio of ETFs. The app asks questions about goals and risk tolerance to choose ETFs. Acorns also rounds up spare change and other contributions to invest.

Pros

- $20 sign up bonus through here.

- Automatic savings features.

- Easy-to-use interface.

- Robust security measures.

- Retail banking feature.

Cons

- Costs $3/month.

- Other apps are more focused on budgeting features.

Acorns primarily serves as an investing app, designed for newcomers to the world of stock market investments. Alongside its core functionality as a robo-advisor platform and offering tax-advantaged IRAs, Acorns also includes a checking account equipped with budgeting features. This combination positions it as a well-rounded solution for those wanting a full-fledged financial app.

Download:

Best budgeting app for hands-on users: YNAB

YNAB

You Need a Budget (YNAB) is a budgeting app that helps people manage their finances. YNAB uses the zero-based budgeting system, which requires users to account for every dollar of their income. The app is designed for people who want to be hands-on with their budgeting and curb their spending.

Pros

- Easy to customize.

- Syncs with multiple devices.

- Free trial for 34 days.

- Easy to track spending.

- Customizable categories.

- Helps set aside money for priorities.

- Real-time updates.

- Integrated loan planner.

Cons

- No bill tracking or bill pay.

- Lack of reporting.

- Steep learning curve.

- No free version.

- Time-consuming.

YNAB has a few features that the other apps do not have, such as zero-based budgeting and goal tracking. Even if it's costly, YNAB can offer several benefits that justify its price of $14.99 per month or $99 per year.

Download:

Best tool to evaluate investment accounts: Personal Capital

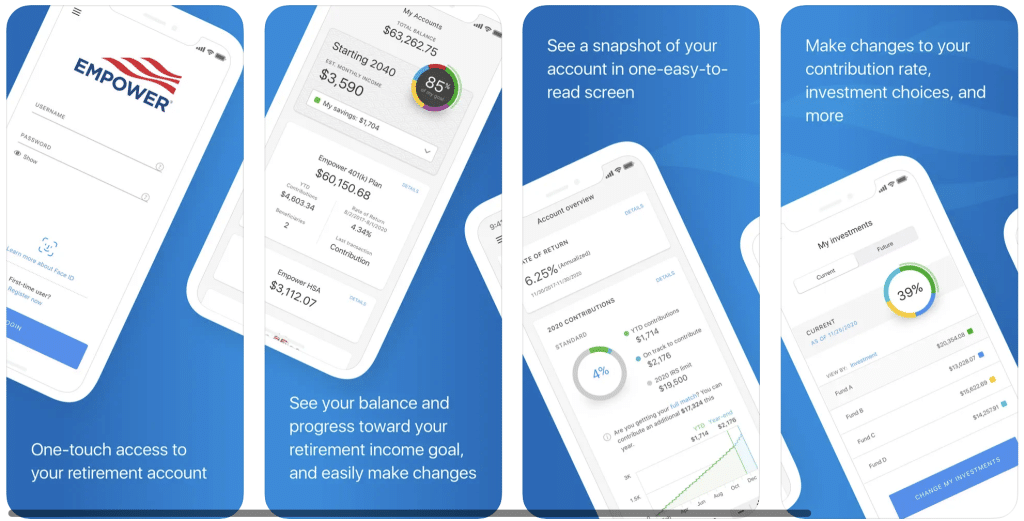

Empower

Empower helps you manage your money easily. You can use it to get smart advice on wealth and free online tools for finances.

Empower is a top-rated app for managing money on your phone. It helps you keep track of your budget and connects with your investment accounts, so you can see all your financial info in one place. It's user-friendly, looks great, and works on computers, phones, and tablets.

The app shows your investments in easy-to-understand graphs. These graphs are sorted by type of investment or account. You can even get advice from investment pros. The best part? It includes your investment accounts in your budget, giving you a complete view of your finances.

Pros

- Tracks investments and spending.

- Free investment management services.

- Robo-advisory services for a fee.

Cons

- Limited budgeting tools.

- Not as user-friendly as some budgeting apps.

Download:

Best apps for stopping spending: Mvelopes and GoodBudget

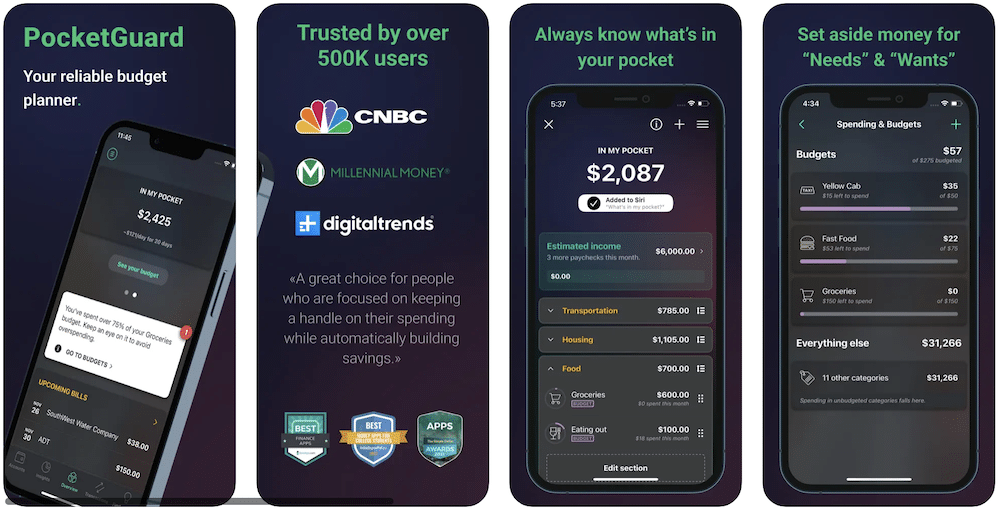

Pocket Guard

PocketGuard is a free budgeting app that helps users manage their finances. It syncs with bank and credit accounts to provide a holistic view of expenses and cash flow. PocketGuard can also automatically update income and transactions and you can create as many savings goals as you want. It offers three budgeting techniques: envelope, zero-based, and 50/30/20 budgeting. You can always see how much money is left after expenses and bills each month as well.

Pros:

- Automated tracking and easy-to-use interface.

- Customizable categories and savings goals.

- Bill reminders.

Cons:

- Limited free version

- No manual categorization

- Not as detailed as some other budgeting apps

Download:

GoodBudget

Personal and household budgeting system for the Web, Android and iPhone. Keep track of money to spend, save, and give toward what's important in life.

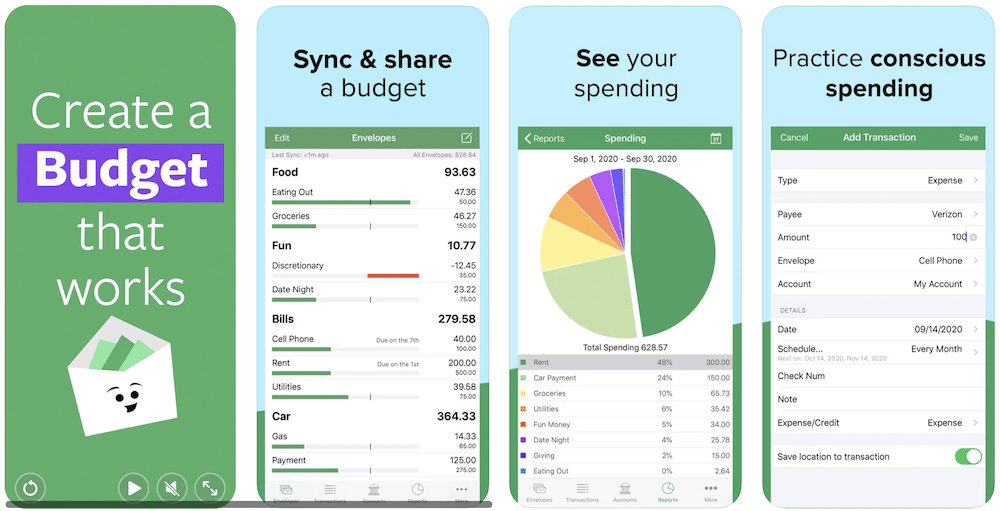

Good Budget, like Mvelopes, earlier discussed, is based on the old budgeting technique of using envelopes. In the beginning, the user is given ten envelopes, but one can boost this to unlimited envelopes after upgrading by paying $6 per month. Once one envelope is empty, you must stop spending, or move money from another envelope.

The application gives you the option to create a budgeting system for the whole home which is can be shared among the members.

Pros

- Simple and easy to use

- Free version available

- Multiple device sync

- Customizable categories

Cons

- Manual transaction entry

- Limited reporting and analysis

- No automatic syncing with bank accounts

Download:

- iTunes – FREE

- Google Play – FREE

How to Budget on Low-Income?

If you are looking to improve your budget (even if you're living paycheck to paycheck) then I can help you with some sound advice. In case you already know about the 50 20 30 budget rule, here are the easiest ways to budget for what life will inevitably throw your way.

College debt

Your education is the most important factor in your future success. Even so, college debt can be the biggest burden on a young adult. Be sure to be diligent in your studies and do not waste your opportunities in college. With all of the scholarship opportunities that are dependent on maintaining grades, you have to be certain that you are going to maintain your GPA to keep those scholarships. Also, be sure to choose a college that is within your budget so that you don't start your adult life in massive debt. If your grades prevent you from continuing your education, it may prevent you from completing it.

Reliable transportation

Do not buy an extravagant vehicle. Find a well maintained pre-owned vehicle and keep it well maintained. Be sure to weigh maintenance costs when purchasing an automobile. What may seem like a good deal may end up turning sour if you have to keep pouring money into a car just to keep it on the road. And weigh the cost of maintaining your current car with the cost of trading in for one that is more reliable. You may want that fancy car now, but a young person needs to focus on the future. Once that is secured, then you can consider a reliable and economic new automobile.

Buying a house

This will be the biggest financial decision of your life. Don't jump blindly into it. Research home values, the neighborhood, and your own preferences on features you want your home to have. This is a decision that can affect your life for decades. Be sure to weigh every single option. Do your homework on the property and make sure that there are no structural defects. Also, make sure you are not in a floodplain. Examine the trees around the property for signs of rot or disease.

Retirement funding

Be sure, above all else, that you pay yourself first. Be sure to take advantage of your retirement options. Contribute to your 401(k) early and often. You may have to sacrifice when you are young, but it will pay off greatly when you are in your 60s and beyond.

Credit cards

Choose your credit options responsibly. Avoid debt at all costs. Just because you have a card doesn't mean that you have to use it all of the time. The key is, never spend more than you bring home. And always, always, always pay off your balance every month.

Remember all of these things. Hard work will get you through the tough times that are to come. Always keep your future in mind. Save when you can, and avoid going into debt at any cost.

Conclusion on Budgeting Apps

Budgeting is an essential skill that helps you manage your money effectively, cut unnecessary expenses, and reach your financial goals. The best budgeting apps make this process easier by providing tools to track spending, set savings goals, and automate your finances. However, while budgeting helps you optimize what you already have, the best way to improve your financial situation is to increase your income.

If you want to boost your earnings, check out these easy ways to make extra money. Plus, you can start right now with a $10 sign-up bonus—click here to learn more!